Financial issues continue to reflect the biggest reason U.S. citizens are denied eligibility to access classified information. We had a subscriber to the ClearanceJobsBlog that was worried his case may be a lost cause.

While complicated, SecretSquid’s chances of obtaining a security clearance is not a completely hopeless case. SecretSquid writes:

“I want to be transparent. I have no issues with criminal activity and my prints were good. I have struggled financially. When my credit was pulled it was around 600 or so (higher on one report). I filed for bankruptcy 2 years ago. My student loans were in default about 7+ years ago, but only for a few months, I immediately brought them out of default. I also owe federal back taxes around $3,500. I have been letting them take my income tax refund and I completely paid off my state tax debt owed. So, my history shows financial issues that I have been working towards resolving, but my fear is that it’s too many issues.

Am I a lost cause?”

Financial Mitigation Techniques

SecretSquid has already deployed some imperative mitigating tactics for individuals who are worried about Guideline F, Financial Issues. Getting your student loan out of default via loan rehabilitation or loan consolidation? Good work. Paying off your state tax debt? Check. Here are a few other financial mitigation techniques that could be viewed positively by adjudicators:

- Pay all bills – on time

- Monitor your credit report

- Enroll in financial workshops/credit classes

- Don’t live beyond your means

- Chat with a security officer/security clearance lawyer about your case

While background investigators gather information, adjudicators will make a decision based on the whole person. If you are working toward becoming debt free and doing everything you can to avoid it in the future, your chances of obtaining clearance may not be completely shot. The defaulted student loan debt is the biggest issue, so if the applicant has the means to pay it off in full rather than using refunds in order to pay off the debt.

REAPPLYING IF YOU ARE DENIED

If you find your chances are shot and you receive documentation that you were denied (Statement of Reasons), however, don’t fret – you are able to reapply for a security clearance at the same agency again after waiting a full year. Every agency is different and may have other specific rules, but this timing is the general guideline.

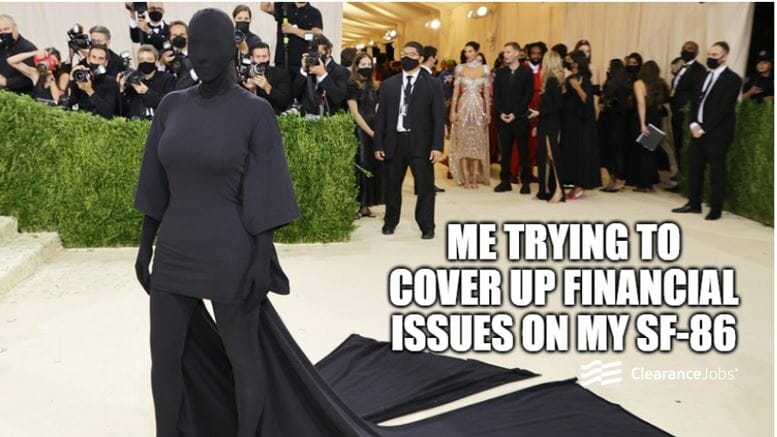

What’s the worst thing you can do? Try and cover up your financial issues from the start instead of admitting fault.

Much about the clearance process resembles the Pirate’s Code: “more what you’d call guidelines than actual rules.” This case-by-case system is meant to consider the whole person, increase process security, and allow the lowest-risk/highest-need candidates to complete the process. However, it also creates a lot of questions for applicants. For this reason, ClearanceJobs maintains ClearanceJobsBlog.com – a forum where clearance seekers can ask the cleared community for advice on their specific security concerns. Ask CJ explores questions posed on the ClearanceJobs Blog forum, emails received, and comments from this site.