Filing the Standard Form 85 (SF-85p) can be stressful, especially when you realize you may have omitted negative information – like late tax returns. Financial issues are a top cause of clearance denial, and tax issues are specifically called out on security and suitability application forms.

Tax questions came into play in a ClearanceJobsBlog Q&A thread when a federal job applicant shared their concern about not disclosing that their 2023 and 2024 tax returns were filed late.

The poster explained they submitted the SF-85 to initiate a background check for a non-sensitive federal position, believing their tax filings were already processed. When they discovered the IRS status hadn’t updated yet, they worried the investigator might view the omission negatively.

“I filled out and submitted an SF 85. I filled out everything to the best of my ability however I filed my taxes late for 2023 and 2024 about three months ago. I checked the status of my returns, and they still haven’t updated on the IRS website. The problem is I didn’t disclose the late return, thinking it was already filed. I did get a letter from the state and I have the transcripts and certified receipt of the returns sent.

My question is will the investigator see this as a problem since I didn’t disclose the fact and it’s not showing on the IRS site?”

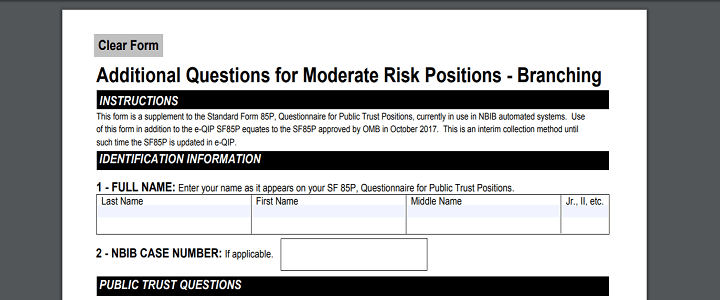

Section 24 of the SF-85p form reads “In the last seven (7) years have you failed to file or pay Federal, state, or other taxes when required by law or ordinance?” The applicant should have answered YES.

Responses from the community focused on two key points:

- Be Honest and Proactive: One contributor recommended being prepared to explain the situation if asked, especially since an SF-85 investigation is looking at overall reliability and integrity, not just paperwork glitches.

- Late Filing Isn’t Usually Fatal: Another responder noted that as long as taxes were ultimately filed and no money was owed, a late filing by itself typically isn’t a deal-breaker. They also emphasized that outright avoiding tax obligations or attempting to conceal information could raise real concerns.

The consensus advice: clarify the circumstances honestly if it comes up in your interview or review. A clear explanation helps investigators understand your intent and helps demonstrate transparency, which is central to background investigations.

Because the public trust application process relies on automated checks and verifications, if the review comes back without showing the delinquent returns, the chances of the applicant’s application moving forward without issues are high.

Much about the clearance process resembles the Pirate’s Code: “more what you’d call guidelines than actual rules.” For this reason, we maintain ClearanceJobsBlog.com – a forum where clearance seekers can ask the cleared community for advice on their specific security concerns. Ask CJ explores questions posed on the ClearanceJobs Blog forum, emails received, and comments from this site. This article is intended as general information only and should not be construed as legal advice. Consult an attorney regarding your specific situation.