Content updated with the latest information from the Defense Security Service:

Should you report bitcoin to your security officer? It depends upon who you ask. A widely circulated email from the office of the PSMO-I recommended reporting bitcoin, as it could be considered a foreign currency. New guidance from the Defense Security Service states: “DSS is working with OUSD-I, and DNI in order to provide clarification to Industry on BitCoin and other crypto-currencies.”

For now, your bitcoin investments are safe from the prying eyes of a security clearance background investigator – but that may not always be the case.

To understand how dealing in bitcoin could affect your security status, it’s important to know a little about bitcoin and—interestingly enough—the history of currency in the U.S.

So What is Bitcoin Anyway?

You’re my neighbor and you’re having a garage sale. You’re selling some old records and the 1976 classic Frampton Comes Alive catches my eye. All that stands between me and Peter Frampton is the $5 price tag. I take a $5 bill out of my pocket, hand it to you—and now I am the owner of some righteous tunes.

Now pause for a second. How does that make sense?

You had something I wanted, I gave you a little green piece of paper and now that thing has become mine. Is that $5 bill actually worth anything in itself? No. It’s just a way to keep track of who has what. It’s an accounting system. That $5 bill says that I own some value—and the federal government will back me up on it.

That’s what Bitcoin is: a digital currency that keeps track of who has what. Except instead of depositing my value into a bank or hoarding dollar bills under the mattress, my value is stored digitally. Every transaction is recorded in a digital ledger (the blockchain) that is open for anyone to see and add to with every transaction. So instead of needing a government or a bank as a third party, transactions occur person to person, anywhere across the world.

This video gives a really great, basic explanation.

Why Could Bitcoin Affect My Clearance?

As you know, security officers look at 13 adjudicative criteria to grant clearances. Unfortunately, many of the same things that make bitcoin appealing also make it potentially suspicious to investigators.

- It’s Anonymous:

Each user exchanges value using an encrypted code that is unique to them. This is great for people who value their privacy.

But you know who else values their privacy? Terrorists, drug dealers and other illicit agents who want to keep their financial dealings shaded from the authorities. You could inadvertently contribute to criminal activity—risking violation of the “Criminal Conduct” guideline.

- It’s De-Centralized:

The value of Bitcoin is not affected by the whims of any government or central authority. The blockchain is open-source. There’s no need to exchange currencies when you want to buy something overseas. This is what its investors love.

Unfortunately, this also makes it suspect in the clearance process. Just as possessing a boatload of Yen or Rubles might send up red flags, being “bitcoin rich” raises questions. Are you partnered with foreign investors? Do you have foreign financial interests that could influence your work? All of these could color the “Foreign Influence” and “Foreign Preference” criteria.

- It’s Digital:

Bitcoin puts everything at your fingertips; it’s built for today’s technology and economy. You don’t have to deal with any banks or bills. It can all happen on your laptop.

But if there’s one thing more foolhardy than a cleared employee investing heavily in bitcoin, it’s using a work-related device to do it. This is a major offense on so many levels, but also would call into question your appropriate “Use of Information Technology.”

I know you would never even consider doing this (and that I’m wasting my breath telling you), but seriously. Just in case you get Nyquil-induced amnesia from cold season, write this down all around your house: NO BITCOIN ON A WORK DEVICE.

History Agrees: Bitcoin and the Federal Government Are Natural Enemies

Like the Hatfields and McCoys, Capulets and Montagues, Bitcoin and the federal government are historical enemies. Arguments over who should control the value, production and flow of currency are as old as the country itself.

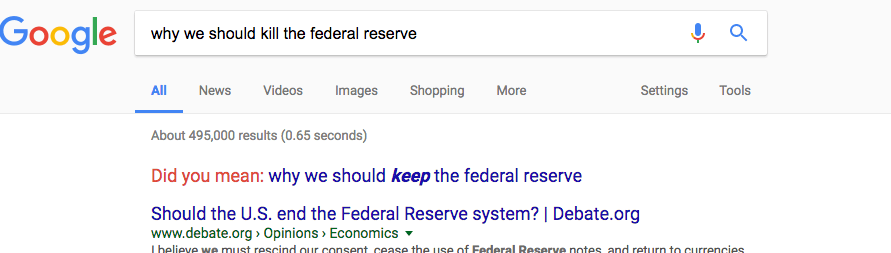

Should the task be centralized with federal government—or given to private individuals and institutions? Thomas Jefferson had an opinion. So did Alexander Hamilton. Andrew Jackson had a *strong* opinion. As you can see below, even Google has an opinion (though I think they’re being pretty passive aggressive about it).

Google is evidently a Hamiltonian.

Many argue that giving the government sole authority over currency is the only way to maintain economic stability and control inflation. For this reason, the U.S. established the Federal Reserve (a central bank). Others argue that the Federal Reserve cannot live up to its mission, artificially controls the economy and gives the government a monopoly on the nation’s wealth.

You can join the billions of living and deceased Americans who have a die-hard opinion about this. Bitcoin is bringing these age-old American questions to the forefront once again. Now a new generation gets to ponder the role of government in currency and the economy.

Given the history of decentralized currency, the government’s natural instinct is to be suspicious of bitcoin. As a result, the clearance process probably will be, too—at least for the time being.