There is no surprise that the U.S. government spends a lot of money, and for fiscal year 2017, the U.S. federal government committed $507 billion in contracts for goods, services, research and development. That’s approximately 13% of the total Fiscal Year 2017 federal budget of $3.98 trillion.

According to a July Congressional Research Service report, Defense Acquisitions: How and Where DOD Spends Its Contracting Dollars, the Department of Defense’s (DOD) contract obligations were equal to eight percent of mandatory and discretionary federal spending.

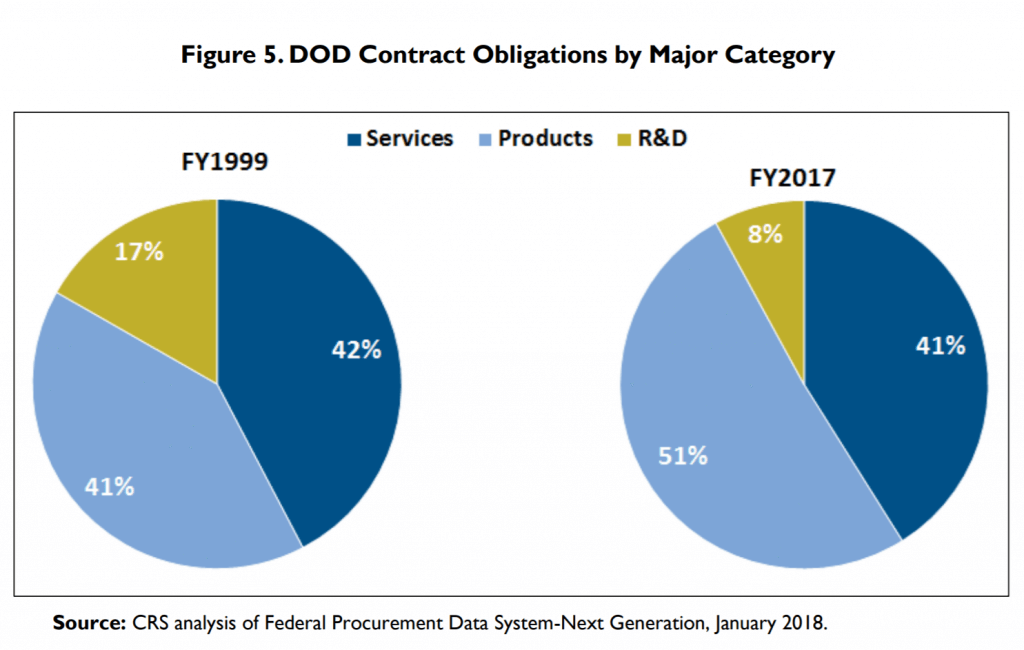

Of this more than half – 51% – of total DoD contract obligations were spent on goods, while 41% were on services. Research and development (R&D) accounted for eight percent. This was in stark contrast to the rest of the federal government, where contracting dollars were spent primarily on services at 71%, followed by goods at just 21%. R&D dollars was on par, also at eight percent.

The most obvious reason for this disparity in spending is that the DoD requires a lot more physical hardware – items ranging from small arms and uniforms to planes, tanks and ships.

“That is a key starting point,and there are a number of ways that the DOD acquires new goods and there is the associated cost of maintenance,” said Gregory Sanders, deputy director and fellow for the Defense-Industrial Initiatives Group at CSIS.

“Simply put they are buying hardware and it is very expensive,” Sanders told ClearanceJobs.

“Services have fallen slightly in DoD, but that is because of productivity increases in the past year,” added Rhys McCormick, associate fellow with the Defense-Industrial Initiatives Group. “The military has bought new planes and ships; that in turn has driven down the spending on services.

And while the government separates procurement by category, the split isn’t always black and white.

“There are gray areas, such as trainers for the next generation of aircraft,” said Sanders. “That could be acquired as a service rather than goods.”

A lesser amount of contracting dollars goes to R&D, which for the past 20 years has been an ever-smaller percentage, dropping from 17% of total contract obligations in FY 1999 to just eight percent last year.

No Great Leaps in Contractor Spending

Overall DoD contractor spending has increased, but not consistently. According to findings from the Federal Procurement Data System-Next Generation (FPDS), from FY 2000 to FY 2017, DoD contract obligations increased from $189 billion to $320 billion (FY 2017 dollars). DoD contract obligations over the past 17 years included annual increases ranging from 11.5% between FY 2000 and FY 2008, which were followed by annual decreases of 6.5% from FY 2008 to FY 2015. From FY 2015 to FY 2017 there was an increase of 6.5% annually.

This steep rise, fall and rise of DoD contract spending made it difficult for the DoD to actively pursue a strategic approach to budgeting.

Yet, adjusted for inflation (FY 2017 dollars), DoD contract obligations have increased from $189 billion in FY 2000 to $320 billion in FY 2017, with goods continuing to get the lion’s share of contract dollars.

“We do expect this trend in disbursement in spending to continue with the DOD,” said Sanders.

While the fall elections could reshape the legislative branch, that may not make a difference in how the DoD – not to mention the whole federal government – divides contractor dollars.

“There has been a bipartisan drive to bring down DoD services,” McCormick told ClearanceJobs. “Both the Republicans and Democrats have been behind this.”

That means regardless of the party in office, it’s business as usual for contractors.

“It doesn’t matter which party is in control of Congress,” added Sanders. “We can look back to the 1990s when the Democrats increased spending. It is really the top line – the executive branch– that makes the difference.”