You are probably aware that Taiwan is officially known as the Republic of China (ROC) since 1949. This powerhouse governs independently of mainland China and enjoys the 13th highest per capita GDP in the world. The People’s Republic of China (PRC) views the island nation as a rogue province, and they vow to “unify” Taiwan with the mainland. There are obviously many issues frustrating Sino-American relations, with Taiwan being one of the more contentious.

What is lesser known to many is the massive semiconductor development, fabrication, and production by Taiwan. The largest company in this sector is Taiwan Semiconductor Manufacturing Corporation (TSMC), commanding a 28% global market share. TSMC is at the forefront of miniaturization, leading in the development of the most sophisticated chips. They are continually pushing the technological envelope with production of 92% of the world’s most sophisticated chips, integrating transistors a thousand times narrower than a human hair. TSMC is arguably the most important semiconductor company, ranking as the world’s 11th most valuable company and a market capitalization of $550 billion.

According to a recent Wall Street Journal article, the second largest market share (13%) goes to United Microelectronics Corporation (UMC), another Taiwanese based company. The state-owned Chinese semiconductor foundry (listed on the Hong Kong Stock Exchange) Semiconductor Manufacturing International Corporation (SMIC) is the third largest semiconductor company (11%). Korean based Samsung is the world’s 4th largest, with 10% market share. The United States (U.S.) is still the world leader in chip design and intellectual property, with technology giants like Intel, Nvidia, and Qualcomm. However, the U.S. only produces 12% of the world’s chips, down from 37% in 1990.

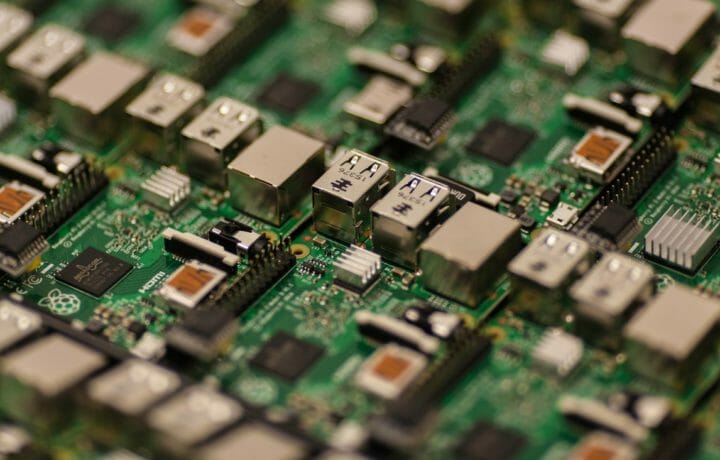

Unfamiliar to many, TSMC’s chips are everywhere – in billions of consumer goods with built-in electronics. They are in our iPhones, appliances, personal computers, and cars, often with no labeling, as TSMC fabricates and produces chips for numerous other businesses. Companies like Apple, and Qualcomm, AMD, Media Tek are all consumers of TSMC. These companies are fabless manufacturing, where they design and sale hardware devices and semiconductor chips while outsourcing their fabrication to TSMC and other similar companies.

China, Taiwan and Microchip Production

What exactly is the problem? Taiwan’s market growth has not gone unnoticed by China. Last year, Chinese based SMIC accounted for only 19% of their domestic chip requirement. Taiwan’s TSMC, produced 55% of all Chinese orders. Adding insult to injury, SMIC performance is not up to par with TSMC. Therefore, SMIC has production goals of increasing chip performance and decreasing Chinese reliance on non-domestic chips through greater production. These goals may prove difficult as the U.S. has restricted access to technologically upgraded production tools, while international controversy on possible patent thefts surrounds SMIC.

With TSMC and UMC dominating the chip market, the world is vulnerable, as both companies reside and manufacture on the island nation that is the flashpoint of U.S. and Chinese tensions. With this and other financial concerns, the world is scrambling to cut their reliance on Taiwanese chips. TSMC’s continual forward thinking and technological growth, decreasing reliance will prove to be a difficult task for the U.S. and Europe.

Balancing relationships with the PRC are increasingly difficult. Yesterday, The Guardian reported Taiwan had pulled back all but one staff member from its Hong Kong trade office after refusing to sign a commitment to the one-China principle as part of visa renewals. Taiwan’s mainland affairs council stated the Hong Kong government has “repeatedly imposed unreasonable political conditions on the visa applications”. Making Taiwanese-Chinese relationships more difficult, this push is another indicator of the Chinese government tightening control over Hong Kong as a semi-autonomous region.

As frustrations continue to escalate, losses to the West could be massive should Taiwan fall to China. Just one of the numerous challenges would be the loss of significant foreign interest, investment, and high technology production within the semiconductor industry, as this sector would be dominated by the Peoples Republic of China.