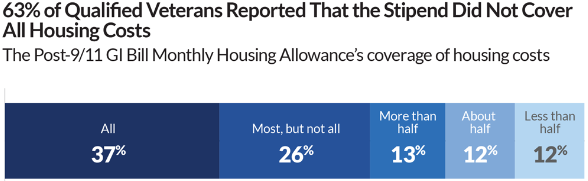

A recent study done for the Pew Charitable Trusts found that for 63% of veterans going to school, their Post 9/11 GI Bill Monthly Housing Allowance (MHA) did not cover all their housing costs. Twenty-four percent of those surveyed indicated their housing allowance covered only half or less of their monthly housing costs.

Source: Veterans Engaging in Transition Studies Survey

Because of this monetary shortfall, veterans using their Post 9/11 GI Bill to go to school are forced to do one of two things – and sometimes both:

- Supplement their income by getting a job

- Take out student loans to cover living expenses.

Each has its own unique set of consequences. And there is a third choice many of them are forced to make – dropping out of school

Supplement their income by getting a job

If the veteran chooses to get a job to create more income, instead of taking out student loans, it creates additional life balance stress. That stress can be either having less time to spend studying, having less time to spend with the family or both.

Take out student loan to cover living expenses

If the veteran chooses to take out student loans to cover living expenses, instead of getting a job and jeopardizing their study time and life/balance, then they are creating a long-term financial hardship on their family that can take years to pay off.

Both end up being a catch-22 and in many cases are the two driving factors for why veterans quit school before finishing their degree. More on that later.

Monthly Housing Allowance (MHA)

This part of the Post 9/11 GI Bill is paid based on the Basic Housing Allowance (BHA) rate of an E-5 with dependents for a particular zip code. It was meant to cover living expenses so that a student could concentrate on their studying and not have to worry about having to work to cover those expenses. However, with inflation rapidly rising, and the MHA only adjusted once a year, it has failed to keep up with rising housing costs – not to mention the rising costs of everything else.

Determining the MHA Rate

Besides the BHA paid at the E-5 with dependents rate, the amount a veteran is paid monthly in housing allowance is dependent on four things:

- Length of service

- Rate of pursuit

- Location of the school

- Whether going to school on campus or online-only

1. Length of Service

The Post 9/11 GI Bill is a tiered system in which the amount it pays in tuition, MHA and books depends on how long the veteran served. The minimum of 50% starts with 90 days of service and tops out at 100% with three years or more of service.

2. Rate of pursuit

Another qualifying factor is if the student is attending school full-time or part-time. The deciding factor lies with the school and what they consider is the number of credits to be considered full-time. It can vary by school, but many consider 12 credits as being a full-time student. Students that are classified as less than half-time (less than 6 credits in this case) are not paid any MHA.

3. Location of the school

The amount of MHA is determined in large part by the zip code of the school. In the case of multiple locations, it is the zip code where the student attends classes. In the case of online school, it is the location the school considers to be their home office.

4. On campus or online only

Many veteran students choose to attend school online for various reasons – PTSD, lack of child care while the spouse is working, etc. However, if taking all classes online, the veteran receives only half of the MHA national average, which at the time of this writing is $938.50 per month.

That 50% rate has never made any sense in that a veteran’s living expenses does not fall 50% by taking classes from home. About the only change is no commuting expenses, which does not correlate to a 50% reduction in MHA.

One workaround to this discrepancy is to take at least one class per term on campus, and the rest can be online, and get the full MHA – twice of what they would gotten by being online-only.

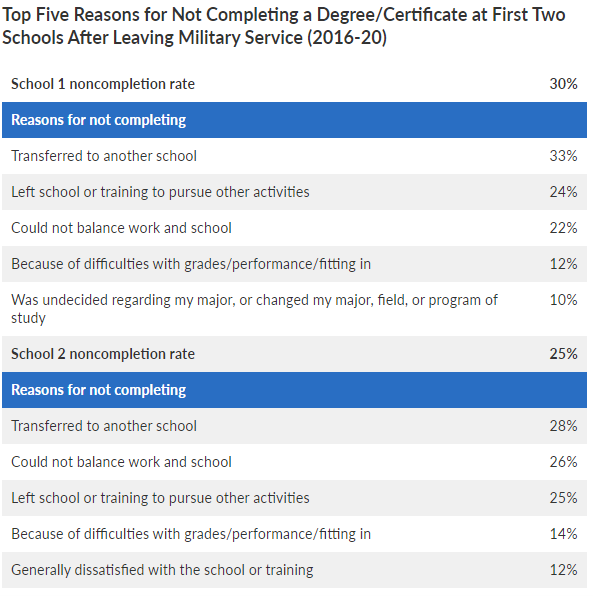

Top Reason for Not Completing Their Degree

The stress of having to work while in school to make ends meet, or to take out student loans in order to devote more time to family and studying, forces 22% of veterans to drop out of their first school and 26% to drop out of their second school. This causes problems when trying to establish a rewarding career because they expended much of their Post 9/11 GI Bill entitlement, but do not have any sort of degree or certificate to show for it. In many cases, they are also stuck with student loans that will need to be paid back.

Source: Veterans Engaging in Transition Studies Survey

Because the MHA rate is only adjusted once a year, this situation probably won’t change anytime soon, at least until inflation falls and the price of housing drops to a level of what the MHA is paying.