The Blended Retirement System, BRS for short, recently celebrated its fifth birthday. The question that comes to mind on its anniversary is “Is it working?” And the answer is a resounding “Yes!”

Under the old Legacy Retirement System or LRS, less than 20% of servicemembers served long enough to qualify for a military retirement. Most had to serve at least 20 years to draw a monthly check. A few were able to go out at 15 years when an early out was offered, but that was sporadic and very limited as far as who was eligible. LRS uses the highest 36 months of pay, which is usually the last three years of service, as the basis for calculating monthly retirement. The formula is 2.5% multiplied by number of years of service multiplied by average highest 36 months of basic pay.

One advantage of the BRS is that most troops will receive a retirement benefit … even if they only serve two years. Granted, it is prorated based on the amount of time spent in boots, but it is more than they would have received under the old LRS.

According to Jerilyn Busch, DoD Director of Military Compensation, about 56% of the Total Force (active duty and Selected Reserve) are enrolled in BRS. That equates to over 1.2 million in uniform. That number breaks down to 850,000 active duty and 450,000 Selected Reserve.

Thrift Savings Plan

One big part of BRS is the Thrift Saving Plan (TSP). Those enrolled can contribute up to 5% of their monthly base pay and get a matching DOD contribution. So, in effect, they are saving 10% per month towards retirement.

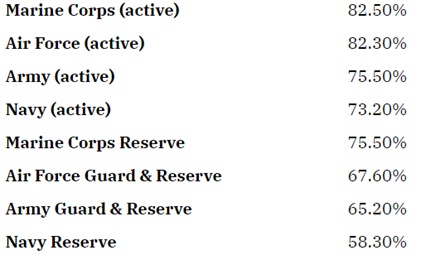

The BRS is helping boost TSP participation. For example, at the end of 2017, only about 48% of the troops eligible were contributing to TSP. After implementing BRS, that figure is now 88% for BRS participants and 78% for those still on the LRS. As a note, those entering military service starting in 2018 were automatically enrolled in BRS; service members having fewer than 12 years could enroll if they chose to do so. Here is a breakdown by military branch as to the overall percentage of service members in that branch are participating in TSP.

Military Branch Percentage of Enrollment

Data Courtesy of the Defense Department

Since 2022, when 401K contributions dropped significantly, military members are putting more into their TSP accounts than what civilians are putting into their 401Ks. One big reason seems to be the DOD 5% matching contribution aspect of the BRS.

BRS

The new retirement system consists of a monthly retired pay for those who qualify, and after 60 days of service, a monthly TSP contribution of 1% of the service member’s base pay. After two years of service, and through their 26th year of service, they can get an additional 4% contribution for a total of 5%.

And since the member can contribute up to 5%, it makes a healthy 10% of the member’s base pay per month that is going into their TSP account each month! For example, in the case of an E-7 with 20 years of service, that amounts to $533 per month going into their TSP account using the 2022 Base Pay Table.

To put this investment in perspective, after five years, the average BRS participant has $11,657 in their TPS account. And even with no additional contributions, that $11,000 over the next 40 years (until civilian retirement age) will grow to roughly a quarter million dollars ($250,000). By comparison, those still in LRS only have on average $39,252 in their TSP and they have been at it a lot longer than BRS participants with TSP starting in 2001.

With any investing, consistent contributions coupled with time left in is a great strategy for building retirement wealth. And once retired, the money can be left in TSP or moved to a civilian retirement account. However, if the money is moved before age 59 ½, tax penalties will apply.

As you can see, it is advantageous to invest as much as allowed towards BRS so that you will have something saved towards retirement … regardless of the number of years served.